For expats moving to Germany, stepping into the financial scene opens up a world of new paths. It’s important to start by opening a German bank account. This guide delves into the steps involved. It covers the different types of bank accounts, what documents you’ll need, confirming your identity, and how long it all takes.

Key Takeaways

- Getting financially stable in Germany starts with a German bank account.

- There are various account types to fit everyone’s needs.

- Gathering the right documents is a key step.

- Proving who you are is crucial for opening an account.

- Knowing the ins and outs of German banking helps expats navigate it smoothly.

Financial Landscape in Germany

The German financial sector greatly helps its mighty economy grow. The country’s banks are crucial, handling lots of transactions every year. They are known for managing risks well. This keeps them stable and very secure.

Most money in Germany is in the banks. These banks take care of the big financial needs of the country. Because these banks are so stable, they have good rates. This makes many choose them for financial services. Their strength boosts Germany’s economy and earns trust worldwide.

Opening a Bank Account in Germany

Expat banking in Germany requires choosing the right bank and account type. It’s important to consider language support and services for expatriates. This makes opening an account smoother.

Accessibility is key for non-German speakers. Many banks have easy-to-use online and mobile apps. But, for in-person banking, look for banks with multilingual staff.

Different accounts offer various features. Some are designed for expatriates, with lower fees and better customer support. This makes them more user-friendly for foreigners.

The documentation needed is important too. You’ll need valid ID, proof of residence, and sometimes a visa or work permit. The process includes a detailed identity check. This keeps everything secure and follows German rules.

Knowing how long it takes to get your account approved is important. It usually ranges from a few days to weeks. This varies by bank and how complete your documents are.

Documents Required for Bank Account Possible duplicatetup

When you want to open a bank account in Germany, you need certain key documents. Having the right paperwork helps check your identity quickly. This makes your banking experience in Germany smoother.

Personal Identification

The first thing you’ll need is a valid ID. This could be a passport, a national ID card, or a similar photo ID card.

Proof of Residence

Then, you must show where you live, whether you’re moving here or already live in Germany. You can use a registration certificate or a recent utility bill with your name and address on it.

Income Verification

Banks often want to see proof of your income. They might ask for employment contracts, salary details, or tax returns. This helps them understand your financial standing. For students, showing your enrolment in a recognized school is enough.

Having all your documents ready and correct speeds up getting your bank account. This way, you get to use German banking services without delays.

Types of Bank Accounts Available

German banks offer many types of banking options for different needs. Knowing about these can help both expats and residents choose wisely. Let’s look into the main accounts like the German Girokonto and Sparkonto savings account, and those for foreigners and non-residents.

Girokonto: Current Accounts

The German Girokonto, or current account, is key for daily money matters. It’s used for getting your salary, paying bills, and setting up direct debits. With features like online banking, debit cards, and overdrafts, it’s great for everyday banking.

Sparkonto: Savings Accounts

If saving is your goal, consider a Sparkonto savings account. These accounts are made to help save money, whether for the short term or long term. With higher interest rates than Girokonto, they’re good for increasing your savings. Sparkonto is ideal for saving up for big purchases or investments.

Accounts for Foreigners and Non-Residents

German banks also have accounts just for expats and non-residents. They offer services like support in English and flexible options for those new to Germany. Online banks are often chosen for their good rates and low fees, making them appealing for expats’ banking needs in Germany.

Top Banks for Expats in Germany

Expatriates in Germany need a reliable bank to build a secure financial future. Deutsche Bank, Commerzbank, HypoVereinsbank, and Postbank are four of the best. We will explore what makes each of them ideal for expats.

Deutsche Bank

Deutsche Bank is known for its top-notch services for expats. It has a variety of accounts with good terms. Expatriates can easily handle their money using the bank’s online and mobile services. The bank offers global support and access to many ATMs.

Commerzbank

Commerzbank offers strong financial products for expatriates. Its English-speaking staff and simple online banking make life easier for expats. Expatriates can get investment advice and open foreign currency accounts too.

HypoVereinsbank

HypoVereinsbank is another great option for expatriates. It provides personalized banking solutions. You can find accounts with high interest and efficient international transfer services. The bank has many branches and offers professional financial advice.

Postbank

Postbank is known for its easy and accessible accounts. Expats like its simple online banking and support in multiple languages. There are different account packages to meet various needs, helping expats manage their finances easily in Germany.

To sum up, choosing Deutsche Bank, Commerzbank, HypoVereinsbank, or Postbank gives expatriates reliable and custom financial services. These banks offer both convenience and financial security for their international clients.

Choosing the Right Bank for Your Needs

When you move to Germany, picking a bank is a big task. It’s crucial to find one that meets your specific needs. The things to look for in a bank are:

- Availability of multilingual support

- Ease of account opening procedures

- A range of comprehensive services

- Bank policies that align with your financial needs

To choose the best German bank, you should compare them carefully. Look at their charges and what extra features they offer. It’s important to find a bank that offers great customer service. Plus, it should have easy-to-use services that help you get settled.

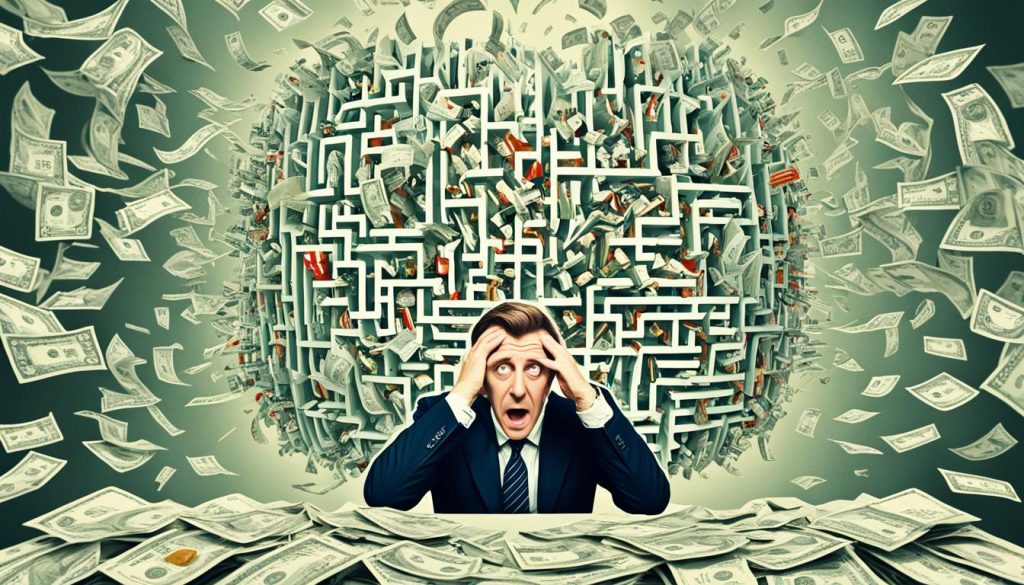

Understanding Account Fees and Charges

Living in Germany means you need to know about banking fees. Learning about account maintenance costs, charges per transaction, and transfer fees helps pick the right bank.

Maintenance Fees

In Germany, banks usually charge account maintenance costs of 5 to 15 Euros each month. Yet, some banks offer accounts without fees if you keep a certain amount of money in them.

Transaction Charges

Many in-Germany transactions are free. But, it’s important to know that using ATMs from other banks might cost extra.

International Transfer Fees

For people living abroad, transfer fees for moving money internationally matter a lot. Banks might charge a fixed amount plus a part of the transfer sum. So, it’s key to compare what different banks charge.

Online Banking and Mobile Banking in Germany

German banks are now more digital. They offer services for easy and quick money management. This is true for both locals and expats. Online banking in Germany helps with better convenience and efficiency.

- Account Management: Seamlessly manage your accounts from anywhere. Transfer funds, check balances, and monitor transactions effortlessly.

- Transaction Services: Enjoy the flexibility of executing various types of transactions, from bill payments to international transfers, directly from your mobile device.

- Customer Support: Access prompt and effective customer support through digital channels, ensuring your banking queries are resolved quickly.

Security and Convenience: In Germany, banking security matters a lot. Banks use strong security steps to protect your information. This lets you bank safely.

Accessibility: Mobile banking is easy to use. It has user-friendly designs. This is very helpful for expats needing banking they can rely on anywhere.

To sum up, using online and mobile banking in Germany has great benefits. It’s safe, easy to use, and helpful for all. It makes digital banking in Germany reliable for everyone.

Financial Technology Innovations in Germany

Germany is leading the way in financial tech innovations. These advancements provide great chances for both locals and expats. They include digital banking, the growing use of cryptocurrency, and new fintech services for various needs.

Digital Banks

Digital banks are changing how financial services work in Germany. They make managing money easier and more user-friendly. N26 and Revolut, for example, offer great digital services for those who love tech and efficiency.

Cryptocurrencies

More people in Germany are starting to use cryptocurrencies. The country has strong rules to make these transactions safe. Bitpanda and Binance are popular platforms for trading and investing in digital currencies.

Fintech Services

Germany’s fintech innovation isn’t just about banking and crypto. It includes services to improve financial inclusion and manage personal finances. Raisin and Solarisbank are leading the charge with solutions that fit into your daily banking. These fintech offerings are changing how we approach finance, making it easier for everyone.

The Regulatory Environment for Finance and Banking in Germany

Germany has a strong regulatory system for finance and banking. It is made to keep the sector stable and strong. Rules cover everything from new tech to fighting money laundering.

Key Regulations

Germany’s banking system follows important rules. These include managing digital security, cryptocurrencies, and being sustainable. They match national and EU banking laws, for better consistency.

Supervisory Authorities

The European Central Bank (ECB) and Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) watch over finance in Germany. They check that banks follow rules to keep the market fair and protect people.

Impact of EU Laws

EU laws have a big effect on Germany’s finance sector. These laws make sure banks operate the same way in all EU countries. This helps with banking across borders, keeps competition fair, and makes the financial system stronger.

Sustainable Finance Initiatives

Germany leads the way in sustainable finance, helping to move towards a green economy. Financial bodies there are aligning with the strict German ESG standards. This alignment is key for achieving both German and EU goals.

Green banking in Germany is central to this shift. Banks are weaving sustainability into their major plans. They focus on supporting projects that are good for the environment, society, and governance. This effort shows Germany’s dedication to fighting climate change and makes it a sustainable finance leader.

The EU’s wider sustainable finance plan also plays a role. It ensures Germany’s German ESG standards match with Europe’s larger aims. This change leads to an economy that is healthy for future and current generations. It tackles today’s environmental issues head-on.

To sum up, reaching a green economy in Germany is a team effort. It involves banks, law-makers, and the government working together. They all emphasize the importance of green banking in Germany. This collaborative approach helps sustainable finance to flourish.

Anti-Money Laundering and Fraud Prevention

Germany’s financial scene is protected by strong anti-money laundering (AML) efforts. These efforts aim to stop financial crime and keep banks safe. Banks in Germany must follow strict rules and use high-tech systems.

This approach helps reduce the risk of financial crimes. It keeps the financial system’s integrity intact.

AML Regulations

German banks are guided by strict AML rules. They have to check their customers carefully, watch over transactions, and report anything suspicious. The Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) makes sure banks follow these laws.

This helps a lot in preventing financial crimes.

Financial Crime Detection

Germany uses the latest technology to fight financial crime. They combine artificial intelligence and machine learning to monitor transactions. This helps spot fraud quickly.

EU laws also help make banking safer by increasing transparency. This makes it harder for criminals to exploit the system.

FAQ

Q: How do I navigate the German banking system as an expat?

Q: What is the financial landscape like in Germany?

Q: How do I open a bank account in Germany as a foreigner?

Q: What documents do I need to open a bank account in Germany?

Q: What types of bank accounts are available in Germany?

Q: What are the tops banks for expats in Germany?

Q: How do I choose the right bank in Germany?

Q: What fees and charges should I expect from German banks?

Q: What online and mobile banking options are available in Germany?

Q: What financial technology innovations are emerging in Germany?

Q: What is the regulatory environment for finance and banking in Germany?

Q: How is Germany engaging in sustainable finance initiatives?

Q: How do German banks prevent money laundering and financial fraud?

Source Links

- https://www.profee.com/articles/german-banks-an-ultimate-guide-for-expats

- https://www.globallegalinsights.com/practice-areas/banking-and-finance-laws-and-regulations/germany/

- https://www.mckinsey.com/~/media/mckinsey/industries/financial services/our insights/german banking returns to the playing field/german-banking-returns-to-the-playing-field.pdf