Starting your own business in the UK is an exciting journey. It opens up many opportunities and lets you bring new ideas to life. The UK’s vibrant market welcomes people who are ready to start their businesses where diversity and creativity shine. Our guide helps you set up your company with ease and confidence.

Beginning a new business can be tricky. That’s why our UK startup guide is carefully made to help you at every step. We explain the legal system and help you find your market niche. Our goal is to smoothly blend your vision with the dynamic British economy.

Understanding the UK Business Environment

The UK business scene is always changing and very important on the global stage. Entrepreneurs looking to succeed in the UK need to know its details. Small and Medium Enterprises (SMEs) are crucial here, driving the economy forward.

London leads as a major hub, but other cities also offer chances for growth and new ideas. Keeping up with economic trends is key for anyone wanting to do well in the UK’s market.

The Role of Small and Medium Enterprises (SMEs) in the UK

Small and Medium Enterprises (SMEs) form the UK economy’s core, job creation and innovation. They push economic growth and support local and national GDP. For new businesses, understanding SMEs’ role is critical to thrive in a varied and adaptable market.

- Contribution of SMEs to job creation and employment stability

- The role of SMEs in fostering innovation and competition

- Understanding the support networks for SME growth in the UK

Regional Business Hubs: London, Manchester, and Beyond

London is a financial giant, but other UK cities like Manchester and Birmingham are key for entrepreneurs. These places show the UK’s sector strengths and offer unique chances for business.

- The financial powerhouse of London and its influence on UK business

- Growth of regional hubs and their contributions to the UK’s economic diversity

- Emerging trends in regional entrepreneurship and investment

Economic Indicators Relevant for New Businesses

Watching economic signs like GDP growth and inflation helps in planning and managing risks. Entrepreneurs who track these can make smart choices, keeping in line with the market. Their success and lasting presence in the market relies on it.

- The significance of GDP growth trends for business forecasting

- Analysing inflation rates to adjust business strategies and pricing

- Employment rates and their impact on consumer spending and business growth

Choosing the Right Business Structure

Starting a business in the UK means picking the right UK company structures. This choice greatly affects an entrepreneur’s future. If you choose to be a sole trader, start a limited company, or form a business partnership, know that each has its own legal and tax rules. These depend on your business size and type.

Knowing the details of these structures helps you tailor your business for success. With the right structure, managing growth becomes smoother and more efficient.

- Sole Trader: Being a sole trader is the easiest way to start a business in the UK. You’re in charge and keep all profits after taxes. But remember, there’s no shield between your personal and business debts. If your business struggles, your own assets might be at risk.

- Limited Company: A limited company protects your personal money if the business fails. But, it requires more paperwork. You’ll deal with annual reports to Companies House and strict tax rules.

- Business Partnership: In a business partnership, two or more people share management, profits, and debts. It’s like being a sole trader but with partners. This setup allows sharing tasks and expertise but needs clear rules to work well.

Your choice will affect taxes, personal risk, paperwork, and how much your business can grow. A sole trader enjoys simplicity, while a limited company offers legal safety. A business partnership might be good for skills and task sharing but can make things complex with money and responsibilities.

- Think about where you see your business in the future. A sole trader or business partnership works well for small, local ventures. A limited company is better for bigger ambitions, including going global.

- Consider how much personal financial risk you’re okay with. Business partnerships and being a sole trader don’t separate your personal and business money like a limited company does.

- Look into which structure is best for taxes. Each UK company structure means different things for business and personal tax.

- Think about how others see your business. A limited company might appear more solid or reputable than other structures.

Spending time to deeply understand the pros and cons of each structure is crucial, not just routine. Seeking legal and financial advice is also a smart move in making such an important choice.

Developing a Robust Business Plan

Starting a business needs a strong base, and at its core is a good business plan. This plan acts like a map, helping you see the way to success. It’s also key when talking to investors. Your plan should cover important parts that match your business goals in the UK.

- Executive Summary: Start with a brief summary of your business. Highlight the main points to grab interest and show your vision and aims.

- Business Description: Share info about what your business does, the problems it solves, and who it helps in the UK.

- Market Research: Do a deep dive into the UK market. Look at competitors and know your audience. This shapes your strategy and supports smart choices.

- Organisation and Management: Describe your business’s structure. Talk about the leaders and their skills to build trust in your business’s success.

- Services or Products: Talk about what you offer. Explain why it’s different and the benefits to customers.

- Marketing Plan: Explain how you’ll draw and keep customers. Include your pricing, ads, and how you’ll sell.

- Financial Projections: Show how your business will make money. Include future earnings, spending, and cash flow.

- Funding Requests: If you need outside money, tell how much and what it’s for, to achieve your goals.

Keep in mind, your business plan should grow with your business. It needs to adapt to the UK market changes. With a strong plan, clear market insight, sensible financial forecasts, and set goals, you’re ready to move forward confidently.

Navigating UK Business Law and Regulations

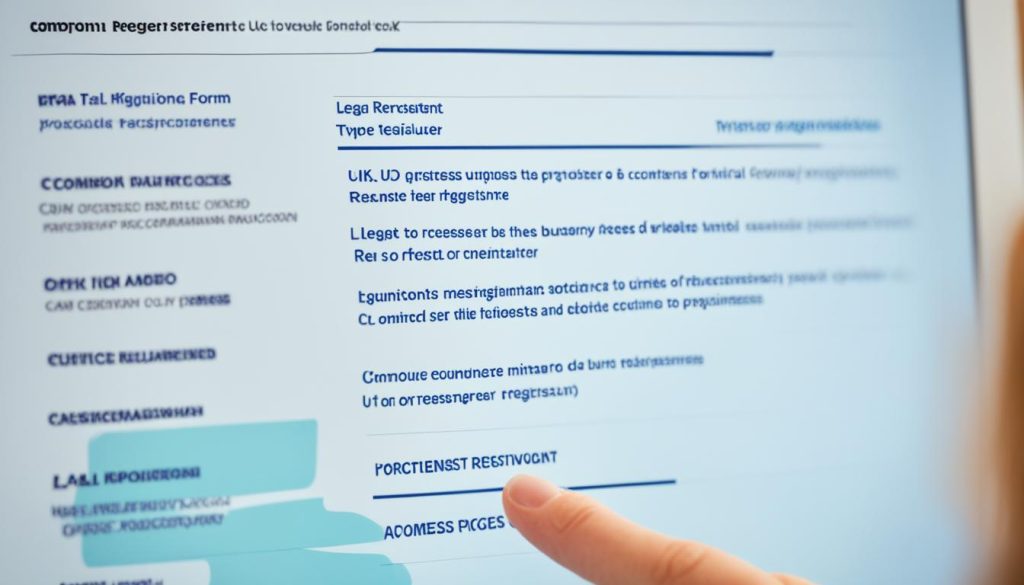

Starting a business in the UK means you need to know about the laws. This includes UK business registration, VAT, taxes, and start-up rules. Knowing these will help your business run smoothly. Let’s dive into these laws that can make or break your success.

Registering Your Business: Steps and Requirements

First, you must register your business in the UK. It forms your company’s legal identity. You need to pick a business name, decide on its structure, and register with Companies House. You also have to sign up for taxes and National Insurance with HM Revenue and Customs (HMRC).

- Choose a company name and business structure

- Register with Companies House

- Sign up for Corporation Tax and other relevant taxes with HMRC

- Understand the ongoing filing and reporting requirements

Understanding Tax Obligations and VAT

Taxes are key for your business planning. You might need to register for VAT if your sales reach a certain level. The law requires companies with high sales to register for VAT with HMRC. It’s crucial to manage VAT properly to avoid fines. Getting expert tax advice is a good idea if you’re unsure.

- Know the VAT thresholds and if/when you need to register

- Choose the right VAT scheme suitable for your business

- Keep meticulous records of sales and input tax for accurate VAT returns

- Submit VAT returns and payments on time to HMRC

Employment Laws for Startup Owners

If you plan to hire staff, knowing employment laws is essential. These rules cover contracts, wages, pensions, and working conditions. Ignoring these laws can lead to fines and damage your reputation.

- Ensure contracts outline the rights and duties of both employer and employee

- Adhere to the National Minimum Wage and National Living Wage rates

- Enrol eligible employees into a workplace pension scheme

- Understand the regulations regarding working hours, holiday entitlement and maternity or paternity leave

Knowing these laws helps protect your business and its reputation. For more guidance, consider getting help from the Advisory, Conciliation and Arbitration Service (ACAS). This will set your UK business up for success from the start.

Funding Your Venture: Available Options

Finding the right finance is key for startups to grow in the UK’s tough markets. There are many choices available, like government grants and startup loans. It’s important to choose what fits your business best.

It’s crucial to know about UK investors when looking to raise money. Venture capital and angel investors not only provide cash but also advice and contacts. However, you’ll need to give up some equity and have a strong business plan.

Many don’t use government grants in the UK because they don’t know about them or find the application process complex. These grants are great because you usually don’t have to pay them back or give up equity. Finding the right grant can really help your business.

Startup loans are essential for funding businesses. Banks, and now other lenders, offer them with good terms for new companies. This includes lower interest rates and payment plans that start later, making them a good choice if you have a plan for paying the money back.

- Understanding UK Investor Climate

- Navigating Government Grant Applications

- Comparing Startup Loan Offerings

Choosing the right funding source is crucial. You must carefully check your options and stay realistic about how much money you need. This will help your business grow and succeed in the UK.

Finding and Choosing the Right Business Location

Finding the perfect spot for your new business is crucial for success. Looking at the busy UK rental scene or thinking about running your business from home, the right place helps you reach your desired customers and work more smoothly.

Factors to Consider When Selecting a Location

Choosing your business location needs careful thought about many things that affect how your business does:

- Accessibility for customers and clients

- Proximity to suppliers and distributors

- The local labour market and availability of potential employees

- Competition in the area

- Infrastructure and logistical considerations

Comparing Rent Costs Across UK Regions

Knowing the UK rental market helps with your budget and planning. Here’s a brief on how rents differ across areas, which may impact your choice of business location:

- London has the highest rents due to its prime office spaces.

- Cities like Manchester and Birmingham mix good locations with reasonable rents.

- Smaller cities and suburbs offer cheap options but still access lots of customers.

The Benefits of Remote and Home-based Business Setups

The shift to remote and home-based businesses brings many benefits:

- They cut down a lot on costs compared to regular business sites.

- They allow you to work flexibly, which helps balance life and work better.

- They save you and your team travel time, making everyone more productive.

Deciding on a location that matches your business goals is exciting. The UK has many choices, from lively city centres to cozy home offices, fitting all kinds of business needs.

Building Your Brand and Marketing Strategy

Today’s fast-moving market shows how vital good UK brand building is. It’s not just about a cool logo or a catchy phrase. It’s about making a brand identity that shows what your business is all about. This identity should connect well with your audience in the UK. You need a good marketing strategy that fits your brand’s values, engages customers directly, and places your market wisely.

To start with, know your audience well. Use demographic studies, look at how consumers behave, and check engagement metrics. These tools help shape your brand’s look and craft your marketing to have the greatest effect. Get into your target audience’s likes and fit into their daily lives. They’re not just buyers; they become part of your brand’s story.

Next, make sure your message is consistent and clear. When your message is the same across all channels, your brand becomes easily recognizable. This recognition will help you stand out in the crowded UK market.

- Identify and articulate your brand’s unique selling propositions (USPs).

- Design marketing collateral that aligns with your brand identity.

- Utilise social media platforms to foster direct customer engagement.

- Consider influencer partnerships to extend your brand’s reach.

- Measure campaign effectiveness through analytic tools and adjust strategies accordingly.

While focusing on online strategies, don’t forget traditional marketing. Trade shows, local events, and print ads offer something digital can’t. Mixing digital and traditional methods boosts your brand’s presence and market position.

Last, be ready to change and adapt as the market shifts. By carefully applying these tips, your brand can do more than just survive in the UK market. It will stand out for quality, reliability, and pleasing customers.

Brexit and Its Implications for New Businesses

The business landscape in Britain has changed a lot because of Brexit. This has led to many challenges and opportunities for startups. Newcomers to the business world must keep up with changes. They need to be flexible to succeed after the UK left the EU.

Changes in Trade Relations and Market Access

After Brexit, the UK’s trade policy changed, affecting how we access markets. Entrepreneurs must grasp these changes and possible tariffs. These could alter costs and how competitive they are. Changes in export rules and new trade barriers mean business plans must evolve.

- Assessing how tariff changes impact product pricing and margins

- Navigating new trade agreements to identify growth opportunities

- Understanding customs procedures and documentation for exports and imports

Adapting to New Immigration Rules and Workforce Challenges

Brexit also changed immigration regulations, affecting who businesses can hire. Companies need to learn about the points-based system. This affects getting skilled workers from the EU and elsewhere.

- Exploring the criteria and costs associated with sponsoring overseas employees

- Adapting recruitment strategies to tap into the local talent pool

- Ensuring compliance with new legal frameworks for foreign labour

Impact on Supply Chain and Business Operations

Brexit has also hit business operations and supply chains hard. Delays at borders, more paperwork, and trade issues can cause disruptions. It’s vital for firms to make their supply chains stronger and look for new ways to manage logistics.

- Identifying and establishing relationships with domestic suppliers

- Investing in supply chain technologies for better transparency and efficiency

- Reassessing inventory strategies to mitigate against border-related delays

Brexit has forced UK businesses to change their strategies. Dealing with these shifts well is crucial for startups to survive and grow.

Networking and Finding Mentors

Starting a business takes more than a great idea. It requires connections that lead to growth. Business networking forms the foundation of many successful companies. By mingling with like-minded professionals, you expand your horizons and find mentors who can guide you.

Mentors offer valuable insights and guidance through your industry’s challenges. They share their experiences and give helpful feedback. This can speed up your business’s path to success. Through networking, you might find partners, get client leads, and discover opportunities for collaboration. Effective networking gives your business a competitive edge in the UK.

- Attend business conferences and workshops, where networking opportunities abound.

- Join industry-specific forums and discussion groups to connect with potential mentors.

- Utilise social media platforms to engage with thought leaders and influencers in your field.

- Participate in community events and charity functions to meet professionals from diverse backgrounds.

- Enrol in professional development programmes where mentorship is often a key component.

Building these connections is key, whether it’s through local events or online. Networking opens doors for your business. Mentorship gives you the knowledge to thrive. This guidance is like a thread that, when added to your business, strengthens it.

- Actively seek opportunities to meet and interact with business leaders.

- Offer to help others in your network, fostering a culture of mutual benefit.

- Regularly keep in touch with contacts, building a rapport based on reliability and consistency.

- Ask intelligent, informed questions when interacting with potential mentors to make a positive impression.

- Be open to feedback and willing to step outside of your comfort zone to embrace new ideas.

In conclusion, building a network with valuable mentors and contacts is a smart move. It provides the wisdom and support you need to confidently navigate the business world. This journey enriches your business with a wealth of knowledge and industry support.

Creating Your Online Presence

Today’s online market is competitive for startups. It’s crucial to grow a strong digital footprint. E-commerce platforms are a huge opportunity. They let you reach potential customers, even when your shop is closed.

Social media marketing connects you directly with people. Facebook, Twitter, and Instagram help shape your brand’s voice. They’re perfect for sharing exciting visuals and stories.

Building your online brand means having a top-notch website. This site should mirror your brand’s values and show off what you sell. It must also be easy to use for a great visitor experience. Let’s look at key things to improve:

- Responsive design: Your website should work well on both desktops and mobiles.

- SEO practices: Make your website easy to find in search results.

- User-friendly e-commerce solutions: Make shopping simple and secure on your site.

- Content quality: Share interesting content that makes you stand out in your field.

Keep consistency in mind as you build your online presence. Your digital footprint is like a shop that’s always open worldwide. It includes all your online activities. Making each one count is crucial for your brand’s image.

In the end, a good e-commerce strategy and smart social media can lift your business. These digital steps are key to connecting with customers. They help build strong relationships and can boost your startup’s success.

Tapping into UK Start-up Ecosystems and Support

The United Kingdom is known for its dynamic start-up culture. It’s supported by a strong ecosystem which helps entrepreneurs succeed. By tapping into available resources like government schemes and incubators, start-ups can get a solid foundation for growth.

Government Initiatives and Start-up Loans

The UK offers strong support for startups through various government schemes. There are start-up loans and tax reliefs to help new businesses. Schemes like the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS) provide essential funding and tax advantages for both investors and companies.

- Start Up Loans: Government-backed personal loans available to the founders of new businesses.

- Enterprise Finance Guarantee: Encourages more lending to small businesses by sharing the lender’s risk.

Incubators and Accelerators: Tailored Support for Growth

Business incubators and accelerators play a key role in the UK’s start-up scene. They offer workspaces, mentorship, investment, and networking opportunities. Designed for start-ups at different stages, these programmes speed up growth and help overcome scaling challenges.

- Business Incubators: They focus on early-stage companies, offering support and office space.

- Accelerators: Provide short-term intensive support and sometimes seed investment for growing businesses.

Importance of Continuous Learning and Education in Business

An entrepreneur’s learning never stops. With business innovation moving fast, constant learning is key to success. Entrepreneurial education gives founders the latest knowledge and skills to adapt to market changes and grow their businesses.

- Workshops, Seminars, and Webinars: Offer education on important business topics.

- Online Courses and Programs: Allow flexible learning on a wide range of subjects, from business management to digital marketing.

Using the support network in the UK can have a big impact on a start-up’s success. It sets the stage for a thriving business career in the UK’s lively economy.

Managing Financials: Accounting and Bookkeeping Essentials

Starting a business in the UK means you must know how to manage money well. Knowing accounting and bookkeeping basics helps you grow and stay financially healthy. You’ll learn to manage a business bank account, use advanced accounting tech, and forecast cash flow. These steps lead to success.

Setting Up Business Banking in the UK

A separate business banking account keeps personal and company money apart. It’s vital for legal and tax rules. Think about bank fees, features, and how it works with your accounting tools. The right bank account helps you manage money better and make smart choices.

Using Accounting Software: Pros and Cons

Accounting software automates tasks and provides instant financial updates. Yet, consider the costs, learning time, and reliance on tech support. Choose software that fits your business size. It should help, not hinder, your financial tasks.

Forecasting Cash Flow for New Ventures

Good cash flow forecasting can save a new business. It involves tracking finances and predicting future costs. Using great banking and accounting tools makes this easier. It helps you overcome money challenges and grow.

Recruitment: Hiring Your First Employees

Hiring staff for your growing business is about more than just filling roles. It’s also about setting up your company’s culture and future. A well-planned hiring approach is key to creating a team that will push your business forward. Knowing about employment contracts and how to build a team is crucial for any business owner.

When hiring, it’s important to look at both the skills of the candidate and how they fit into the team. Here are some basic steps to help you hire effectively:

- Create detailed job descriptions that show what each role involves.

- Set up a selection process to check candidates’ skills, experience, and fit with your company’s values and vision.

- Learn about employment contracts to make sure you follow the law and clearly explain job details and conditions to candidates.

- Think about how new team members will affect your current team and encourage a culture of working together and supporting each other.

Employment contracts are central to hiring. They are official agreements between your business and your staff, covering important details like pay, duties, and work conditions. Making sure these contracts are properly written is vital. It helps with following the law and building trust with your team.

Building a team should be ongoing, not just a single activity. Start by encouraging team spirit from the beginning. Promote open communication, set common goals, and celebrate achievements together. All these activities help strengthen your team and move your business forward.

In short, a good hiring plan that includes understanding employment contracts and team building can make your start-up’s workforce strong. With the right team, your business can overcome market challenges, adapt to changes in the industry, and achieve its goals.

The Role of Technology in Modern Start-ups

Today, using advanced technology is essential for start-ups to succeed. It’s not just an extra benefit. Technology like e-commerce and automation helps entrepreneurs manage their businesses better. It protects their assets and supports growth. This makes startup technology a key part of today’s business world.

Leveraging E-commerce Platforms and Online Sales

Having a good online store can help start-ups grow by reaching more people. E-commerce doesn’t just make shopping easier for customers. It also gives businesses important data. This helps them offer what customers want and make their shopping experience better.

- User-friendly interface design to attract and retain customers

- Integration of secure payment gateways to build trust

- Scalable infrastructure to grow with the business

Improving Efficiency with Business Automation Tools

Start-ups need to be efficient to stay ahead. Automation frees up time by handling routine tasks. This lets entrepreneurs focus on big decisions and new ideas. There are many tools available for automating things like marketing emails and managing relationships with customers.

- Identifying time-intensive tasks and selecting the right tools for automation

- Integrating CRM systems to track customer interactions and sales

- Employing cloud-based services for seamless team collaboration

Protecting Your Business with Cybersecurity Measures

In the digital economy, start-ups must be aware of cybersecurity risks. Protecting data is crucial to keep customers’ trust. Start-up founders need strong cybersecurity plans in place. This is to guard against data breaches and other online threats.

- Regular updates and patches to keep security measures current

- Employee training on best practices for data protection

- Implementation of firewalls and encryption tools to deter cyber threats

Planning for Growth and Scaling Your Business

When growing your business, understanding how to scale is key. If your UK business is getting stronger, it’s time to look at new markets. This can bring new life to your efforts. Here are some main points to think about for business growth:

- Assess Your Current Position: Check how solid your business is before scaling. This makes sure you’re ready for more growth.

- Outline Scaling Strategies: Choose between growing step by step or quickly. Pick strategies that fit your business and market chances.

- Invest in Growth Management: Growing affects everything from customer service to how you manage supplies. Good growth management keeps quality high.

- Explore Market Diversification: Moving into new areas or offering more can boost growth. But, make sure your plans are well-researched.

- Build a strong base that can handle more demand.

- Keep making customers happy as you grow.

- Train your team well for upcoming changes.

Risks come with expanding your business. Be ready for market shifts, new rules, and more competition. Diversifying can protect you from these risks and open new earnings paths.

There’s no single way to grow a business. Your expansion plans should suit your goals and what you have. With careful planning, you can manage growth well and use new markets to reach your big aims. This will strengthen your stand in the UK market.

Conclusion

Starting a business in the UK is an exciting journey filled with possibilities. This guide has shown you the key steps for success. It highlights the need to understand the UK business scene and to plan carefully. For the ambitious entrepreneur, setting up a business is an achievable aim. All it takes is hard work, good planning, and determination.

Choosing the right business structure and connecting with the right people are crucial steps. We’ve covered everything needed to enter the UK market successfully. This journey includes legal matters, financial strategies, and using the latest technologies. Each is vital for building a successful business in the UK.

Let this guide be more than instructions. Let it inspire you to turn your business dreams into reality in the lively UK market. With the best tools, a strong business plan, and a commitment to your goals, your start-up can thrive. It can reach great heights in the competitive UK business world.